Precisely what is Spend Fake pay stub maker free?

Then you are at the right place. So we can help you in getting this work done as we use our own fake bank statements editing, fake paystubs editing, fake utility bills editing and fake tax returns editing. We can edit or design or create all sorts of documents either in the form of a PDF or scanned documents. How do I make a payslip? As an employer, your payslip needs to be designed in consultation with your HR, your CA or your accounts person. Otherwise, you can have a look at some of the following samples of Salary Slip formats and pick the one you think you need. They’re in Excel, Word, and PDF formats. Download Salary Format In Excel, Word, PDF.

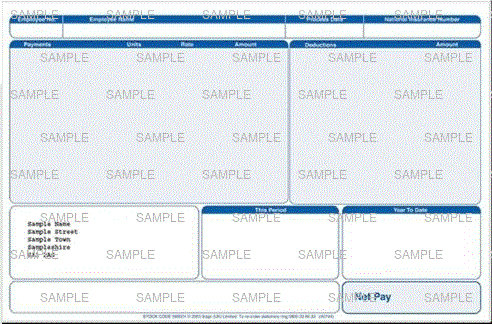

Spend Fake pay stub maker free is An immediate document that has certain layouts of pay stubs where by the consumer can edit in order to utilize it by will need. A pay out stub is often a type of evidence of wage or payment for the employee. The significance of a shell out stub is to provide clarity on the amount income is obtained from the corporation or place of work.

The extra ingredient is actually a sort of revenue that may be extra in nature. These incorporate the primary wage, fastened allowances, attendance allowances, overtime fork out, and bonuses. The two components above instantly influence the ultimate nominal degree of revenue being paid by the company to staff members. So workers will see all information and success of their last payment within the paycheck.

Exactly what are The necessity of Fork out Stub for Employees?

- Pay back stubs are a kind of official and legal evidence of payment for employees

The necessity of fork out stubs supplied to personnel is a notification which the fulfillment of their rights to operate in the shape of wages has actually been paid. There will be indicated the date the wages ended up issued and compensated for the reason that this doc was created together with the payroll timetable. With this shell out stub, The main gain is averting disputes over the fulfillment of wage rights when you’ll find problems from staff who assert not to obtain gained them.

- For a Kind of Evidence of Earnings from Workforce

Aside from getting a sound proof of payment as well as proof of staff do the job cash flow. Shell out stubs can be employed for several uses, certainly one of that’s for credit rating. Hence the essential side of your pay back stub Here’s to aid creditors in knowing their capacity to shell out or simply identify whether or not they are borrowed or not.

- To be a Method of Transparency in Calculating Worker Salaries

Each and every spend stub issued will involve a detailed calculation of the employee’s revenue. The value of fork out stubs is to offer transparency inside the calculation, like deductions and extras offered.

- To Help Firms in the Pay back Transparency Program

The problem of salaries in organizations in Indonesia is confidential and transparent like it remains foreign to listen to. The value of spend stubs Here’s that they’re not a confidential corporation document, but details that is certainly legitimate and might be accessed by all workers.

In depth on How to Generate a Pay out Stubs with Shell out Fake pay stub maker free

You can start subsequent the steps if you would like make your own personal pay-stubs in A neater way. There’ll be some areas that you’ve to incorporate to generate a proper one. In this article you go!

- Step #1: Produce Firm name

The First component that kinds and must be about the pay stub could be the identify of the business, agency or institution as being the bash issuing the fork out stub. This could be a validity position or entry which the pay stubs are in truth issued from a corporation for their employees.

Fake Payslips Download Software

- Step #two: Point out Document confidentiality Statement

The sentence that constantly worries the confidentiality of the paycheck is generally “non-public and private”. This statement exhibits that not everyone exterior the parties anxious may possibly know these confidential files. So the pay stub is only issued to the individual involved.

- Step #3: Kind the Date When Payment Was Built and Staff Details

An example of a pay stub also involves information and facts in the shape with the date of payment of salaries to employees together with employee facts such as identify, personnel quantity and Taxpayer Identification Number.

- Step #4: Include Description of the Amount of Salary and Particulars

Yet another thing that should be A part of the sample company pay out stub is the level of the worker’s wage, full with specifics, particularly extra or deductions imposed on workforce.

Fake pay stub maker free are going to be printed each month and supplied to workforce like a created report. Nonetheless, In addition there are firms that use electronic spend stubs which can be despatched to every employee’s competing account.

12 photos of the 'Fake Pay Stub Maker Free'

Fake Payslips Downloads

Working in an organization, you may have often come across a slip addressed directly to an employee indicating their salary and allowances for a particular month. This slip is known as a payslip. Payslips are issued every month and to every employee. A pay slip is a statement showing how much an employee earned in a gross amount less the deductions for Special funds such as Providence and pension funds. Payslips are commonly used in organizations big or small.

In older days, pay slips were printed and given to employees as hardcopy. This practice is still common in some organizations. Many organizations also choose to email the payslips to employees.

Large organizations usually have online portals for their employees to manage their profiles, file online applications, and manage other administrative duties. These organizations also use the employees’ portal to upload payslips. So, each employee can log in into the portal and access their payslip online. Uploading on the online portal saves considerable paper and expense.

There are several benefits of payslips. Payslips are a way of communication about the salary between the organization and its employees and it works to effectively minimize any misunderstandings. Payslips can also prove helpful during external and internal account audits. Payslips are useful in comparing discrepancies that may arise when calculating provident or pension funds.

Every organization, big or small, issues payslips to its’ employees. A payslip is a statement of income and deductions for a particular employee. Each payslip is unique to a particular employee with their name on it. The payslip for one employee cannot be given to another since it is addressed to the employee with his/her name and employee ID.

Payslip and payroll both refer to two separate concepts. A payslip shows the salary and deductions for a particular employee only. On the other hand, a payroll is the list of all the employees working in an organization. The payroll not only lists the employees but also their salaries, bonuses, and any taxes withheld. Thus, the payroll is the total amount of salaries paid by an organization, and a payslip is for an individual employee.

In terms of importance, a payslip is important for the employee, so they are aware of the breakdown of their salary. Similarly, the payroll is critical for the HR department in the organization since any discrepancy in the payroll may cost the organization a huge loss. It is the responsibility of the HR department to ensure that the payroll is accurate and timely.

Both payroll and pay slips are generated at regular intervals. These intervals can be weekly, bi-monthly, or monthly. The most common duration is monthly.

A payslip generally includes:

- name of the organization

- name of the employee

- employee ID

- gross salary for the month

- any allowances such as housing, travel or communication allowance

- bonuses if applicable

- deductions for providence fund, pension funds

- taxes withheld

- net salary

A payslip may also include the past few months’ histories of gross and net income. The net salary is the take-home salary that the employee can spend.

A payslip is an internal, yet binding document issued by an organization. If someone wants to apply for a loan or credit card, they can use previous payslips as proof of salary. Moreover, by law, every organization must provide payslips to all its employees every time a payment is made to the employees. Thus, an organization that pays bi-monthly, must provide bi-monthly payslips. Thus, payslip is a legal document.

Fake Payslips Download

See the templates below.

Preview

MS Excel [.xls] | Download

Weekly Payslip template

MS Excel [.xls] | Download

Biweekly Payslip Template

MS Excel [.xls] | Download

Monthly Pay Slip Template

MS Word [.docx] | Download